-

Life Insurance

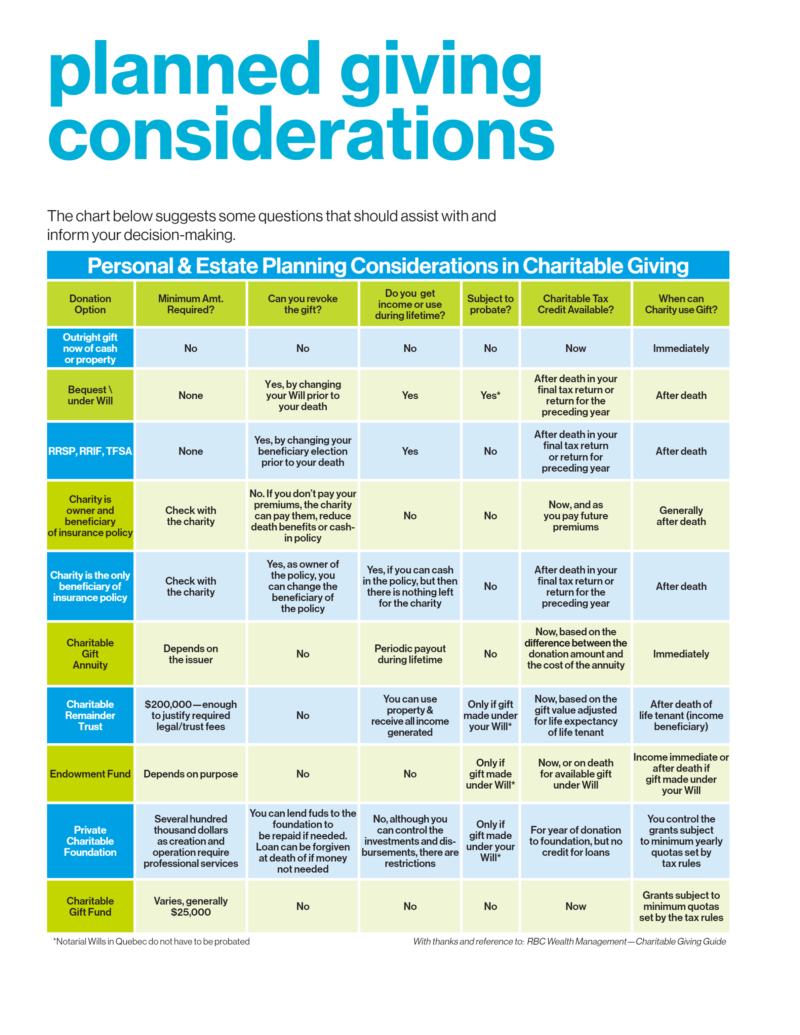

Life Insurance is often something we don’t wish to think about. Yet it can be a creative way to provide for your loved ones and heirs, while still making a donation to a charitable cause that is important to you.

-

RRSP, RRIF & TFSA

Retirement funds that you no longer need can have a tremendous impact when donated to Habitat for Humanity Halton-Mississauga. Your estate will receive a receipt to offset taxes due from the distribution of the RRSP, RRIF or TFSA, which are among the most heavily taxed assets you own.

-

Major Gifts, Endowments & Pledges

When you make an ‘outright’ gift of cash or property to Habitat for Humanity Halton-Mississauga, 100% of your donation is used to build affordable housing right here in Halton and Peel regions.

-

Charitable Bequests

A bequest to Habitat for Humanity Halton-Mississauga is not only a lasting gift that will help us continue to deliver on our mission locally, but remembering us in your Will also has practical benefits for your surviving heirs. Your estate will receive a tax receipt for the full amount of the donation which may offset capital gains or other taxes due.

-

Gifts of Real Estate

Finding land upon which to build is one of Habitat for Humanity Halton-Mississauga’s biggest challenges. A gift of real estate enables you to make a bigger charitable difference than you may have thought possible. It also helps you to avoid estate taxes and minimizes or eliminates any burden placed on your heirs.

-

Publicly Traded Securities

One of the most financially sound ways in which to support the good work that Habitat for Humanity Halton-Mississauga does right here in our community is through a gift of securities. When you donate publicly traded stocks, mutual funds and other securities directly to a registered charity, you pay no capital gains tax and receive a tax receipt for the full amount of your gift.